Tesla Inc. has posted better-than-expected results for the fourth quarter, announcing plans to invest approximately $2 billion into CEO Elon Musk’s artificial intelligence startup. The company is preparing for production ramps of Tesla Semi and CyberCab in North America, set to commence in the first half of 2026. Additionally, Tesla plans to unveil the Gen 3 version of Optimus in the first quarter of this year.

Financial Highlights

- Quarterly earnings: 50 cents per share, beating the consensus estimate by 12.36%

- Quarterly revenue: $24.9 billion, exceeding the analyst consensus estimate of $24.78 billion

- Tesla shares rose 2.3% to $440.32 in pre-market trading

Company Statement

Tesla reflected on its progress in 2025, stating that it “further expanded our mission and continued our transition from a hardware-centric business to a physical AI company.” The company highlighted its advancements in FSD (Supervised)4, the launch of its Robotaxi service, and the installation of production lines for Cybercab.

Analyst Reactions

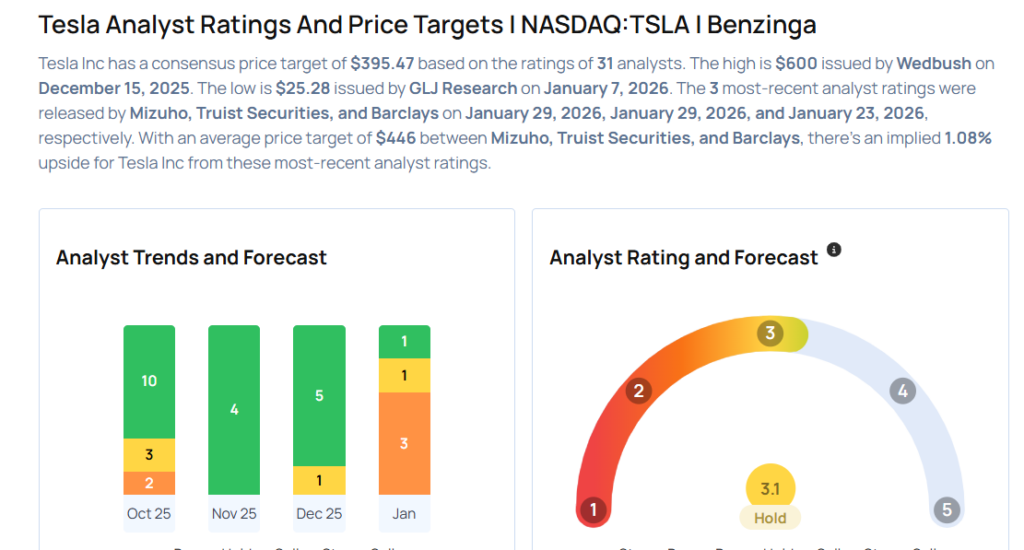

The following analysts have made changes to their price targets on Tesla:

- Truist Securities: Maintained Hold rating, lowered price target from $439 to $438

- Mizuho: Maintained Outperform rating, raised price target from $530 to $540

Investing in Tesla

Considering buying Tesla stock? Analysts have adjusted their predictions following the Q4 earnings report. It’s essential to stay informed about the latest developments and analyst opinions before making any investment decisions.

Image

Photo via Shutterstock